child tax credit payment schedule for september 2021

Newspostwall Publishers 3 weeks ago. Under the American Rescue Plan most eligible families received payments dated July 15 and Aug.

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

All payment dates.

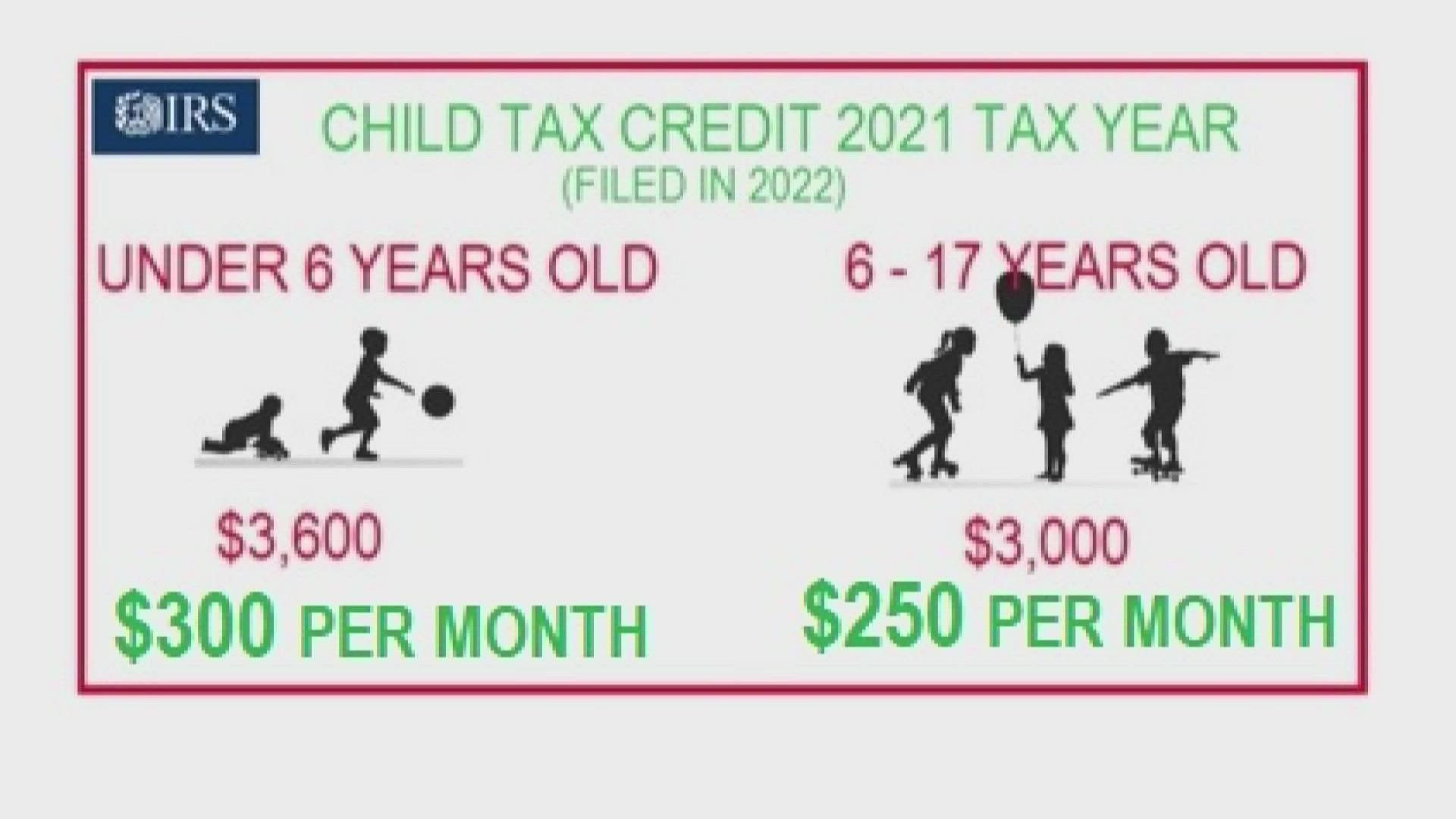

. So each month through December parents of a younger child are receiving 300 and. September 19 2021 500 AM 2 min read Ridofranz Getty ImagesiStockphoto The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

Get your advance payments total and number of qualifying children in your online account. October 5 2022 Havent received your payment. 13 opt out by Aug.

Each payment will be up to 300 for each qualifying child. Enter your information on. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

September 19 2021 500 AM Ridofranz Getty ImagesiStockphoto The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36. The complete 2021 child tax credit payments schedule. Child tax credit payment.

The schedule of payments moving forward is as follows. 15 opt out by Aug. Recipients can claim up to 1800 per child under six this year split into the.

The third of the six advance monthly Child Tax Credit payments will hit bank accounts 15 September. The payments will be paid via direct deposit or check. The percentage depends on your income.

What is the schedule for 2021. Wait 10 working days from the payment date to contact us. September payment date opt-out deadlines IRS portal details.

Up to 300 dollars or. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and. Child tax credit 2021.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. The payments were authorized through President Bidens American. The majority of payments will be issued by direct deposit.

To reconcile advance payments on your 2021 return. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Six payments of the Child Tax Credit were and are due this year.

Up to 300 dollars or 250 dollars depending on age of child August 15 PAID. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days.

Parents Your Bank Account Gets A Boost On September 15 Wfmynews2 Com

September Child Tax Credit Payments How To Fix Mistakes Money

Irs Sends Out September Child Tax Credit Cw39 Houston

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit Update Third Monthly Payment On September 15 Marca

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Some Families Missing Out On Child Tax Credit

2021 Advanced Child Tax Credit Basics Are You Missing Your September Payment Youtube

Families Will Soon Receive Their December Advance Child Tax Credit Payment Those Not Receiving Payments May Claim Any Missed Payments On The Upcoming 2021 Tax Return Passaic Valley Nj News Tapinto

Childctc The Child Tax Credit The White House

What To Know About The First Advance Child Tax Credit Payment

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Stimulus Update Important Dates For Next Child Tax Credit Payment When Will Money Arrive Al Com

Child Tax Credit December 2021 How To Track Your Payment Marca

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

How To Get The Child Tax Credit Massachusetts Jobs With Justice